In this article, Daria Lyubchenko and I look back at the time when we worked for the EBRD small business lending projects. Russian banks were only starting to work with small businesses and “high interest rate” seemed to be the main stopper for potential borrowers. Today, doing research for a project in Central Asia, I hear similar concerns from entrepreneurs and can only repeat what we used to say to our clients twenty years ago: interest rate is not the main thing when one talks about small and micro loans. In the growing markets, banks should learn to work with small businesses, examine their numbers and listen to the voices of their owners. When a “meeting of minds” takes place, both banks and businesses benefit.

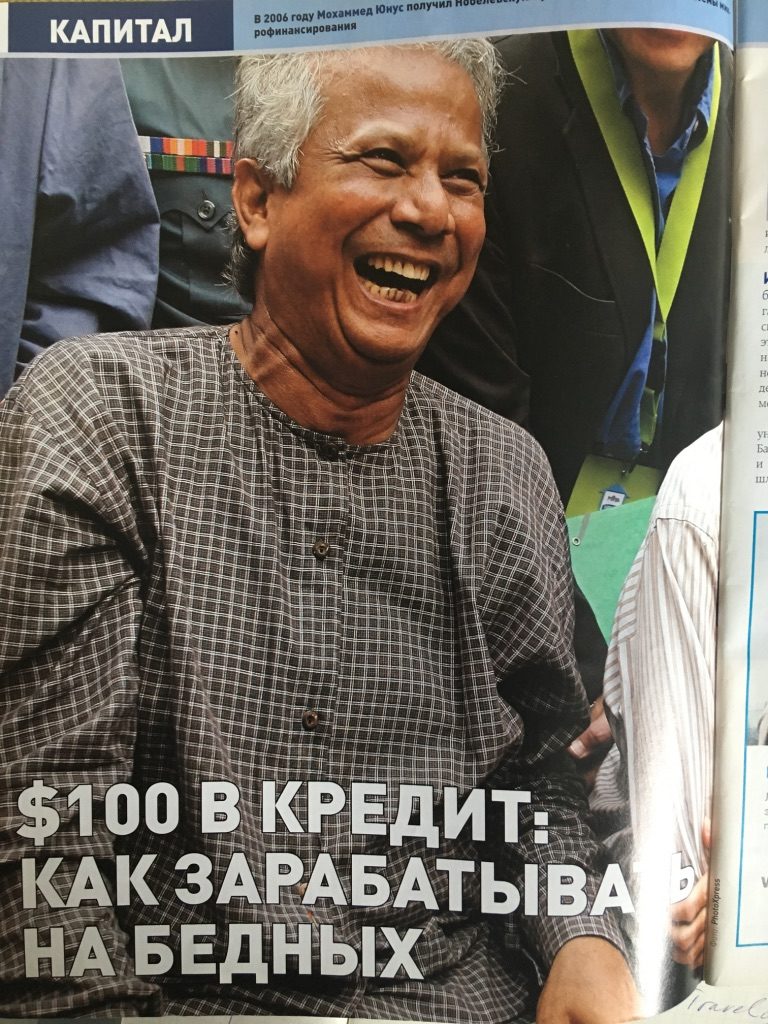

On the photo: "$100 loan. Can one earn anything, lending to the poor?" In 2008, my daughter, a student journalist at the time, was looking for professional experience and wanted...