I would like to share the stories of several people who arrived in Portugal three years ago and launched their entrepreneurial projects. From 1996 to 2005, I was a loan developer in international small business lending programmes. I started with the US South Shore Bank and later joined the EBRD Russia Small Business Fund. Examining both the financial data and the personal stories behind each business is crucial to ensure the loans are repaid. I have been interested in small businesses ever since.

SQM Remedy system, best in class

In this post, Vera Kolpakova (Senatorova) speaks about the time when we worked together. SQM Remedy system was one our first important initiatives. “Agile” and “scrum”, these words were not known then. Someone probably watched us in 2006 and coined the terms to describe our approach. We asked Vica Alexandrova and Marina Kodryan to contribute, and so they did. And there are more stories to tell about that time and our SQM team!..

Burning Bridges

On June 22nd, 2022, I posted the article “I will burn this money on Crimea Bridge” on my Russian website. Let the title not mislead you: the customer I quoted had referred to the Crimea bridge in Moscow over the Moskva river. The quote dates back to 2008, when Crimea was part of Ukraine, and that bridge to the island of Crimea did not exist. The June post “I will burn this money…” told the story of my bank account opening in Portugal. That little victory over the red tape is now past, so the English version is more about banks’ rules and compliance procedures in general. Nothing new for bankers but might be interesting for bank customers. I am finalising this English version much later. I have not heard a voice approving the war among my close friends and relatives. Yet there is a vast country out there. Some people are in shock and enduring reality; others accept sick ideas and follow criminal orders. Two months ago, young friends from Moscow came to stay with me, medical doctors who did not want to be mobilised. They miss their dog and their flat; they keep working online for their pharma companies doing business in Russia. One can blame them for not being interested in politics but I do not see that they differ much from European young people I know. The posts I write here and in social networks are my way to stay connected with my own voice and with others. Life is with people. Transparent, accessible, and fair financial services connect people.

Credo, credis, credit. On banks, credits and small businesses

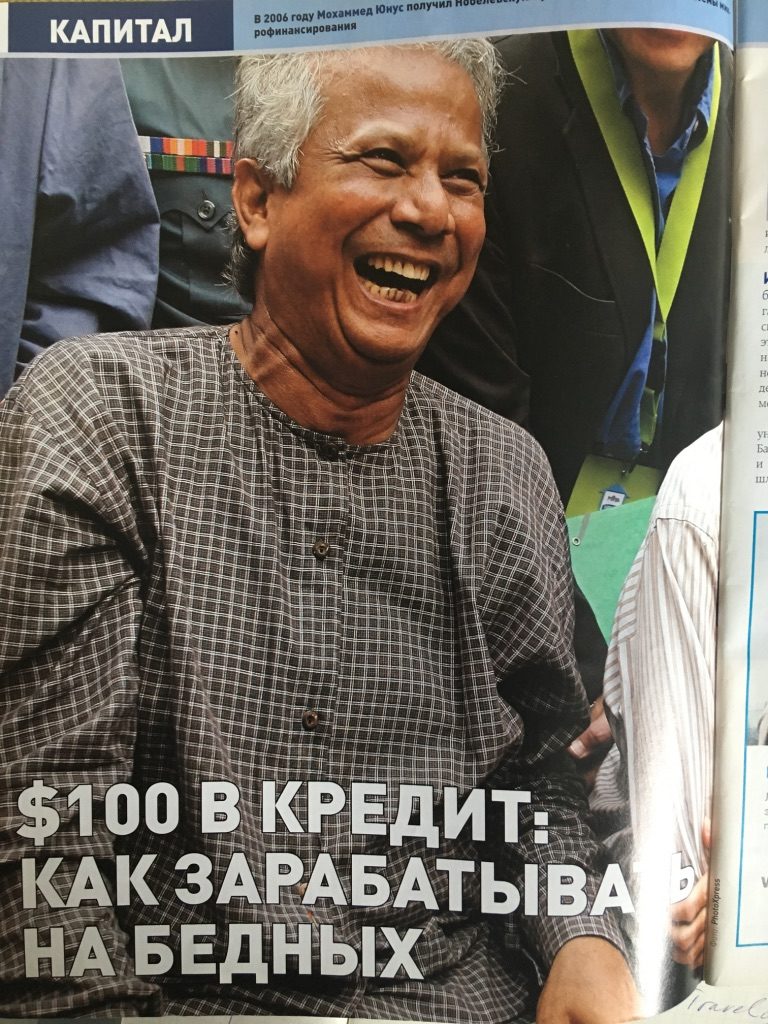

In this article, Daria Lyubchenko and I look back at the time when we worked for the EBRD small business lending projects. Russian banks were only starting to work with small businesses and “high interest rate” seemed to be the main stopper for potential borrowers. Today, doing research for a project in Central Asia, I hear similar concerns from entrepreneurs and can only repeat what we used to say to our clients twenty years ago: interest rate is not the main thing when one talks about small and micro loans. In the growing markets, banks should learn to work with small businesses, examine their numbers and listen to the voices of their owners. When a “meeting of minds” takes place, both banks and businesses benefit.

Dreams of Casablanca and the Ten Commandments of the Lender

Banker To The Poor

Coronovirus marketing of banks and other mills on a stomy river

February 18th, 2020. Interview with Nadia who owns and runs a hat manufacturing business.

She came to a bank branch where I was responsible for development of small business lending and represented the EBRD Russia Small Business Fund, in June 1998. The company was founded by two graduates of the Textile Institute and made women’s hats for autumn and winter.