In 2019, I was lucky enough to go several times to Morocco, for work. The last trip was in December, which in Casablanca feels like May in Moscow.

Morocco is so multi-cultural, it is impossible to describe it as a country belonging solely to the Arab world. Still, European-style outdoor terraces with the Internet are hard to find. People tend to eat and talk sheltered from the sun and even from daylight. Luxury interiors hide behind sometimes dilapidated facades, often in not very well-maintained streets. They dig and drill here and there, lots of dust in the air, “making use of the funds allocated” perhaps! For several years we’ve seen this type of activity in Moscow each summer, and here December is probably the season.

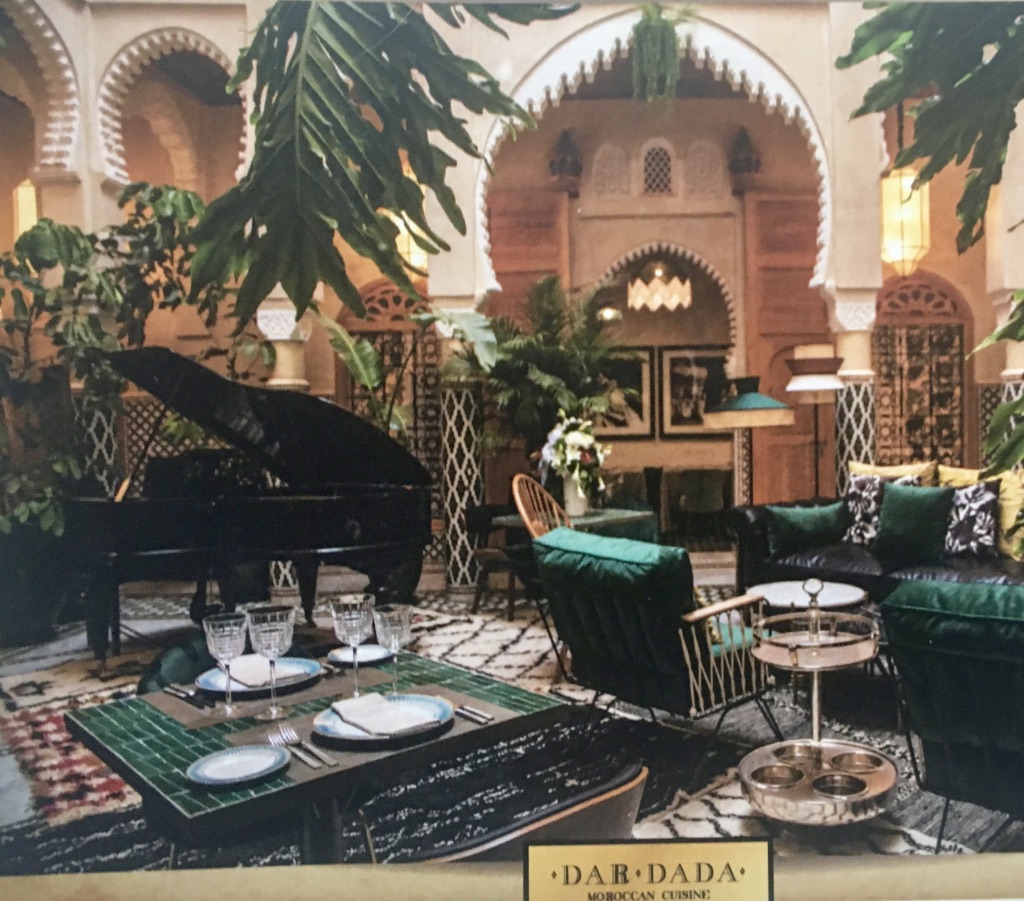

I am in Moroccan restaurant in Medina (Casablanca old town), it is large, bright, noisy, rich in carpets and gilding, arches and galleries, there is a taste of fruit and honey in all I eat. The minimum price of ordering food for one person is 400 dirham, so there is no incentive to eat less. Tall and strong-looking waiters smile affectionately and say “yes, madam, of course”, then give the same nice smile in half hour when you try to remind them what you asked for… We agreed with my colleagues that the next day, quite apart from work programme, I will join the managers of the partner bank and will come again to Medina to visit the Women’s Support and Training Centre (le Centre de Renforcement des Compétence Féminines). Meryem and Maria became my guides.

I am in Moroccan restaurant in Medina (Casablanca old town), it is large, bright, noisy, rich in carpets and gilding, arches and galleries, there is a taste of fruit and honey in all I eat. The minimum price of ordering food for one person is 400 dirham, so there is no incentive to eat less. Tall and strong-looking waiters smile affectionately and say “yes, madam, of course”, then give the same nice smile in half hour when you try to remind them what you asked for… We agreed with my colleagues that the next day, quite apart from work programme, I will join the managers of the partner bank and will come again to Medina to visit the Women’s Support and Training Centre (le Centre de Renforcement des Compétence Féminines). Meryem and Maria became my guides.

At the centre, we are welcomed by Sabah Chraibi, lawyer, university lecturer, founder and president of the national association ESPOD (Espace Point de Départ, Space for Start). Sabah has been in gender law and gender research since the 1980s and was a member of the commission that developed Morocco’s new Family Code in the 1990s. She is convinced that women’s economic autonomy offers important opportunities both for the individual family and for the whole country.

At the centre, we are welcomed by Sabah Chraibi, lawyer, university lecturer, founder and president of the national association ESPOD (Espace Point de Départ, Space for Start). Sabah has been in gender law and gender research since the 1980s and was a member of the commission that developed Morocco’s new Family Code in the 1990s. She is convinced that women’s economic autonomy offers important opportunities both for the individual family and for the whole country.

Classes at the training centre are aimed at developing professional skills that are also useful for life – cooking, making clothes.

Sabah stresses that unfortunately the existing educational system in the country orients students towards the life of the employees, “wage earners” and does not make sufficient emphasis on knowledge that helps to achieve economic independence through entrepreneurship. ESPOD unites very different people, there are owners of quite big companies and experienced lawyers. The task of this association is to help other women to start a business and find determination and strength within themselves.

Sabah stresses that unfortunately the existing educational system in the country orients students towards the life of the employees, “wage earners” and does not make sufficient emphasis on knowledge that helps to achieve economic independence through entrepreneurship. ESPOD unites very different people, there are owners of quite big companies and experienced lawyers. The task of this association is to help other women to start a business and find determination and strength within themselves.

While student mothers are in class, they can leave their children here at the Centre with the teachers. It is good to see roughly equal number of boys and girls in the class. These kids know Masha from the Russian cartoons «Masha and the Bear»!”See?” – Meryam laughs – “We love your Masha.”

Medina’s windows do not look welcoming. When will one see cafés, shops or workshops behind every one of them? The wish to start a business and the skills acquired at the Centre might not be enough. One needs financing and opportunities to rent small premises at an affordable price.

As for loans, the Moroccan market, as far as one can understand by reading Moroccan sites in locked-down Moscow, there are new excellent opportunities.

King Mohammed VI initiated a program last October, to support young entrepreneurs and start-ups: businesses that have been working for less than five years can get a loan at 2% per annum. Under the COVID-19 quarantine, when many businesses put their activities on hold, banks are encouraged to issue support loans based on the guarantees of a special government fund. Are things changing fast enough in lending?

Moroccan banks know how to lend to large enterprises and individuals. But neither traditional approach nor retail approach are suitable for micro and small businesses. If there were dedicated departments for lending to SME… That’s what we were talking about with Maria and Meryem on our way back. This is exactly how the EBRD’s programme in Russia worked: from practising small business lending in one department as an experiment – to creating procedures and a holistic system. To do this, in addition to the will of the bank’s management, there should be a strong support group among employees – enthusiasts of small business development, doing lots of work not only in the office but in the field as well.

To do this, in addition to the will of the bank’s management, there should be a strong support group among employees – enthusiasts of small business development, doing lots of work not only in the office but in the field as well.

Among the training materials of the Joint Vienna Institute, which I keep from the EBRD Russia Small Business Fund times, I still have the “Ten Commandments of the Lender”. They are good for any lending team that works not only with documents and scoring systems, but also with people.

Here they are:

- Thou shalt look upon each loan request and application as a challenge and an opportunity – not a chore.

- Thou shalt nor prejudge or pre-evaluate but listen carefully and with empathy

- Thou shalt not pretend to have knowledge you don’t have or about which you are in doubt.

- Thou shalt not become so engrossed in detail that you cannot see the business as a unified whole.

- Remember in lending that it’s not simply how good the collateral is… but also how liquid.

- Thou shalt not commit yourself prematurely before getting all the facts and considering all the aspects.

- Thou shalt not refer the difficult work to the ‘loan committee’ or the ‘board’ or the ‘bank’ for them to make a judgement.

- Thou shalt simply and clearly explain the reasons for any refusal of a loan request.

- Thou shalt accept full responsibility and make decisions promptly on your own when you know you have all the necessary facts, have considered all aspects of the case and have sound reasons for the decision you make.

- When thou hast concluded from the facts and your deliberations that you are going to say “yes”, say it ungrudgingly.

Lending to small businesses is a fascinating job. I am wishing success to all my Moroccan colleagues who dream, just as I do, of a new Medina, with elegant facades and open cafés.